Washington—Specialty drug spending growth might be slowing down—at least a bit, according to Doug Long, who spoke at the 2016 National Association of Specialty Pharmacy’s annual meeting.

In 2015, many experts forecast double-digit growth in spending on the drug class. But based on current market trends, he expected single-digit rather than double-digit gains, warned Mr. Long, the vice president of industry relations at QuintilesIMS.

“A lot of our advocators were thinking that in 2020, specialty would be 50% of all the pharmaceuticals spent. I do not think it’s going to get to 50%. It’s 36% now; you may get into the low 40s,” he predicted. “It just goes to show you when somebody looks at a projection and thinks it’ll go up forever, it never goes up forever.”

The primary driver of this market downturn will be the direct-acting antiviral agents used to treat hepatitis C virus, Mr. Long noted. With list prices of more than $80,000, the sticker shock for these high-priced cures reverberated throughout the industry when DAAs were first introduced. As more entered the marketplace and third-party payors could negotiate better pricing, exclusive contracts and enforce prior approvals, the prices started to decline—at least a little.

As prices come down, and more baby boomers are tested for HCV, DAAs might be prescribed for more new patients. In addition, DAAs appear to be a cure. The more people who are treated, the fewer individuals who need medication. “We are at the tail end of the HCV era,” he said. “A lot of people who were going to get treatment have already gotten treatment, and the new patient starts are lower than in 2014 and 2015.”

Despite the slowdown, the specialty market is still growing faster than traditional medications.

Biosimilars and Pricing

One driver that will lower prices for branded products but provide opportunity for competitors will be biosimilars. The first biosimilar to be approved in the United States was Sandoz’s Zarxio (filgrastim-sndz), which is a noninterchangeable biosimilar to Neupogen (Amgen) for neutropenia. It was approved in March 2015 and was launched in September 2015 at about a 15% discount to Neupogen.

“When there’s multiple entrants, there’s a lot of price competition, and some of the blocking strategies manufacturers employ won’t work when there’s two or three, or four [choices],” Mr. Long said. “There are a lot of people working at this [developing new biosimilars].”

The exclusivity also has expired for Enbrel (etanercept, Amgen), Humira (adalimumab, Pfizer/AbbVie), Remicade (infliximab, Janssen), Neulasta (pegfilgrastim, Amgen), Epogen (epoetin alfa, Amgen) and Procrit (epoetin alfa, Janssen). In 2017, Lemtrada (alemtuzumab, Sanofi/Genzyme) will lose exclusivity, leaving plenty of opportunities for biosimilars to enter the market and increase competition.

Already, the FDA has approved Pfizer/Celltrion’s Inflectra (infliximab-dyyb), a biosimilar to Remicade; Sandoz’s Erelzi (etanercept-szzs), a biosimilar to Enbrel; Amgen’s Amjevita (adalimumab-atto), a biosimilar to Humira; and Basaglar (insulin glargine, Boehringer Ingelheim/Lilly), a biosimilar to Lantus (sanofi-aventis).

“I fully expect that it will be a vibrant biosimilar marketplace before the end of the decade,” Mr. Long said.

Legal Battles Ahead

Aimee Tharaldson, PharmD, who spoke at the Academy of Managed Care Pharmacy’s 2016 Nexus meeting in National Harbor, Md., said specialty pharmacists could expect discounts of about 15% to 30% for biosimilars, which will act like competing brands. But they will face substantial legal battles over patents before they can be brought to market. Another issue will be interchangeability. Not all biosimilars are interchangeable with the reference product, and pharmacists would not be able to automatically substitute them for the reference biologic as they can for traditional generics and branded drugs, which would have an effect on savings, she said.

Despite the legal hurdles, the pipeline is strong for biosimilars, Dr. Tharaldson and Mr. Long said. Another biosimilar approval for Remicade by Merck and Samsung was expected as Specialty Pharmacy Continuum went to press. Later in the year, the approval of biosimilars to Neulasta, Herceptin (trastuzumab, Genentech) and Avastin (bevacizumab, Genentech) are possible, according to Dr. Tharaldson, a senior clinical consultant of emerging therapeutics at Express Scripts.

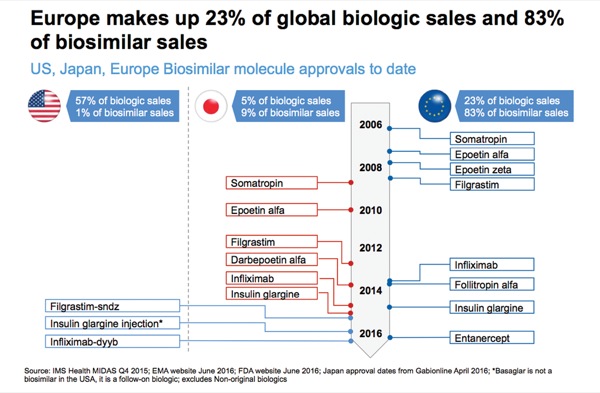

Dr. Long said the biosimilar players in the United States are interesting. In Europe, the traditional generic companies—Teva, Hospira and Sandoz—were the ones bringing biosimilars to market. In addition to those, the United States is seeing the likes of Pfizer, Merck and Amgen, as well as smaller companies like Celltrion.

“The No. 1 pipeline is by Pfizer; the No. 2 pipeline is by Amgen; and I think it’s quite interesting that Amgen is going after Ambien [zolpidem, sanofi-aventis] on Humira. Sandoz is going after Amgen on Enbrel. And we’ll see how this all plays out,” Mr. Long said. Although there are three generic companies in the space, “brands are now getting into this marketplace, so that’s an important thing to note,” he said.

And when one looks at the numbers, it is easy to see why: 57% of all the biologic sales worldwide are made in the United States, but fewer than 1% of all the biosimilar sales are from the United States. In contrast, 83% of all the biosimilar sales and only 23% of the branded sales are in Europe.

“So, you can see how active that market has been,” he said.

The bottom line is that the way to see health care savings in specialty pharmacy will be a vibrant biosimilar market, according to Mr. Long.

Innovation will continue to be a driver of the specialty industry. “We expect that in the next five-year period there will be more, new active substances available on a global basis than any other five-year period in the last 30 years. And where are they going to be? They’re going to be in infection. They’re going to be in oncology. They’re going to be in neurology,” Mr. Long noted.

He added that a little more than 40% will be traditional small molecules; 25% will be specialty small molecules; and then there will be more biologics and biosimilars. “The key thing to see over the next five years is how the specialty market penetrates the traditional primary care classes and traditional classes.”

An unknown driver will be Washington, D.C. Right before the election, Congress was up in arms about the cost of medications. And the new president has already told pharmaceutical companies that he expects them to lower prices. In addition, the current administration is determined to repeal the Affordable Care Act, which created the pathway for the approval of biosimilars. No one knows what will happen to the millions of people who got their insurance through the exchanges or what the repeal will do to insurance premiums and drug prices.

“One percent of U.S. patients consume 26% of the health care, and 1% or 2% of prescriptions represents 36% of reality [in specialty use]—small prescription; big dollars,” Mr. Long said.

Mr. Long predicted that specialty manufacturers will continue to see a price backlash that will grow more intense; more consolidation so that companies can specialize in certain areas; and reimbursement and rising costs will continue to be concerns for specialty pharmacists, insurers and patients.

—Marie Rosenthal

The sources reported no relevant financial relationships outside of their stated positions.